www.yourretirementbenefits.net/metlife – MetLife Employee Benefits Account Login

Get Access To MetLife Employee Retirement Benefits Account

MetLife is a holding corporation associated with the Metropolitan Life Insurance Company (MLIC). It was established way back on March 24, 1868, about 149 years ago. It operates all of its operations from the head office based in the MetLife Building, New York, New York, U.S. It provides the services like the Insurance, Employee Benefits and the Annuities, etc.

After retirement you have to have some savings depending on which you can support yourself and your family too. So, MetLife is offering the best retirement plans and you must get it. Here, check more information about the same.

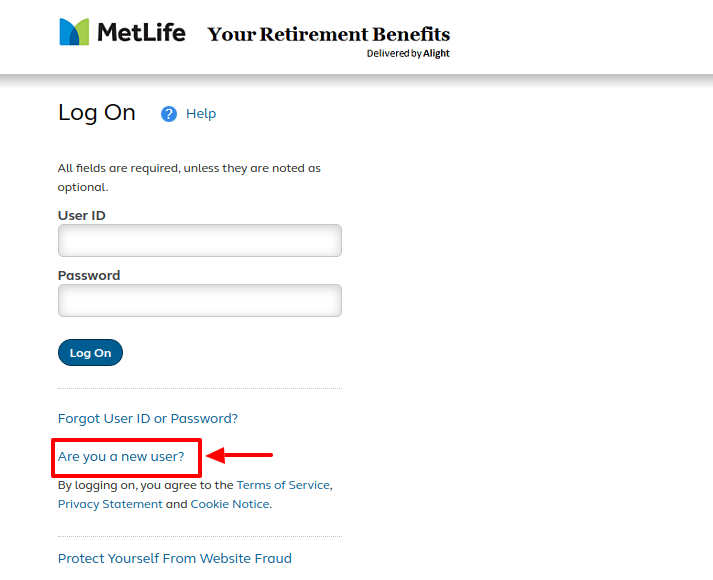

New user enrollment of MetLife

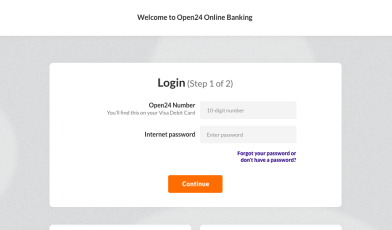

For this visit, www.yourretirementbenefits.net/metlife

Here, at the middle left side under the login blanks, click on, ‘Are you a new user?’,

In the next page at the middle enter,

You have to follow the prompts to get the new account.

Logging into MetLife

To log in, go to, www.yourretirementbenefits.net/metlife

Here, at the middle left side, you will get the login blanks. Here, input,

-

The user ID

-

The set password

-

Then, click on, ‘Log on’ in blue.

You will be logged in.

Forgot user ID or password

If you have lost the login details of MetLife, then in the same login page, under the login blanks at the left click on, ‘Forgot User ID or Password?’.

In the next page at the left middle side type,

-

Last 4 Digits of SSN

-

Birth Date

-

Then, click on, ‘Continue’.

You have to follow the prompts to get the information back.

Also Read : Linebarger Goggan Blair & Sampson Tolls Payment Guide

The retirement benefits of MetLife

Vesting Benefit: Sum Assured + Vested Simple Reversionary bonus plus Terminal Bonus, if any.

Death Benefit: Death Sum Assured + Accrued Simple Reversionary Bonus + Terminal Bonus, if any; (Where Death Sum Assured is defined as 105% of all Premiums paid (excluding service tax and extra premium, if any))

Flexibility: You can defer the vesting date up to age 75 years.

Death Benefit

The Death Benefit is Higher of {Death Sum Assured + Accrued Simple Reversionary Bonus + Terminal Bonus, if any}, where Death Sum Assured is defined as 105% of all premiums (excluding service tax and extra premiums) paid. The Death Benefit will not be less than the Surrender Value under the policy.

Options to the Nominee on death of the Insured

To utilize the entire proceeds of the policy or part thereof for purchasing an Immediate Annuity from the Company at then prevailing rate.

Withdraw the entire Death Benefit amount as a lump sum

The policy terminates with the payment of death claim amount.

Vesting Benefits

If the insured survives and the policy is in-force till Vesting Date, the Vesting Benefit shall be:

Base Sum Assured + Accrued Simple Reversionary Bonus + Terminal Bonus, if any.

Options on Vesting

-

To utilise the full Vesting Benefit to purchase Immediate Annuity from us, which shall be guaranteed for life, at the then prevailing annuity rates.

-

To commute to the extent allowed under Income Tax Act as lump sum and to utilize the balance amount to purchase Immediate Annuity from us, which shall be guaranteed for life, at the then prevailing annuity rates.

-

To use the Vesting Benefit to purchase a Single Premium Deferred Pension policy available at that time to defer the purchase of Immediate Annuity. This product can only be purchased from us.

-

To extend the accumulation period within the same policy with same terms and conditions if you are then aged below 55 years

-

The policy terminates with the payment of Vesting claim amount.

Simple Reversionary Bonus

The policy will participate for Simple Reversionary Bonuses from year three

Terminal Bonus

In addition to Simple Reversionary Bonuses, the Company may also declare Terminal Bonus from year five onwards. The Terminal Bonus is payable along with death or vesting benefit.

Policy terms of MetLife

-

Min. Age at entry*: 30 years

-

Max. Age at entry*: 64 years (Limited Pay 10 years). 65 years ( Others)

-

Min / Max. age at Vesting*: 50 / 75 years

-

Minimum Sum Assured: Regular Pay & Limited Pay 10 Years: Rs 300,000. Limited Pay 5 Years & Single Pay: Rs 500,000

-

Maximum Sum Assured: As per MetLife Board Underwriting Policy

-

Premium Payment Term: Single Pay / 5 Pay / 10 Pay / Equal to Policy Term

-

Minimum Policy Term: Premium Payment Type

-

Regular Pay & Limited Pay: 5 years

Limited Pay 10 Years

Single Pay

-

Minimum Policy Term: 10 years

11 years

5 years

-

Maximum Policy Term: SP: 20 years

Others: 30 years

-

Minimum Annualized Premium: Premium Payment Type

Regular Pay

Limited Pay 10 Years

Limited Pay 5 Years

Single Pay

Additional information on MetLife

-

Highlights of Retirement plans

It is advisable to plan for your retired life from an early age to get maximum benefits.

Use the retirement calculator to estimate the amount you would need to invest now, to lead a comfortable life, post-retirement. There is an algorithm with factors like inflation rate, retirement age, the present cost of living etc. to derive an approximate figure.

You receive regular payouts post your retirement which is called Annuity. An annuity can be received on a monthly, quarterly or yearly basis, depending on your policy type.

An affordable premium has to be paid to get these benefits.

-

Things to keep in mind before choosing your retirement policy

Calculate the approximate figure of money you would require to sustain a comfortable life, post your retirement. Find an appropriate plan that meets your requirements.

Check the affordability of the premium rates and the efficiency of the claim procedures in advance.

Research on all the options available and then settle on a plan.

-

For opting on MetLife

In order to sustain post retirement, you need to preplan and save up well in advance.

Financial self-sufficiency is a boon that will help you in your second innings.

Retirement goals like the desire to pursue hobbies, go on a world tour etc. can only be fulfilled if you have retirement plans that help you complete these goals.

Nuclear family setups are common in today’s day and age. It is imperative to be prepared to look after yourself, so that there are no changes in your lifestyle.

Contact details

To get in touch with MetLife, you can go on calling, on the toll-free number, 1-800-677-5678

Retirement Benefits Service Center Hours

Weekdays 8:00 a.m. to 6:00 p.m., Monday to Friday.

1-847-883-1080

Outside the United States, Puerto Rico, or Canada

Weekdays 8:00 a.m. to 6:00 p.m., Monday to Friday.

Reference :

www.yourretirementbenefits.net/metlife