How to Activate Capital One Credit Card

Capital One is a US-based, bank holding company. They are basically specialized in credit cards, savings accounts auto loans, and banking. Capital One was formed in 1994. Capital One headquarters is located in Capital One Tower, McLean, Virginia. As of Fortune 500, they ranked 98th. In Fortune’s “100 Best Companies to Work For” it has ranked 17th.

How to Activate Capital One Credit Card

You can easily activate your Capital One Credit Card online or over your phone. You can choose any of the following methods to activate your Capital One Credit Card:

Activate Capital One Credit Card via Online Method

You can easily activate your Capital One Credit Card via the online method. Make sure to have a Capital One online account to activate your card. To activate your credit card, you must have to log in to your account. You can simply follow these instructions below to activate your Capital One Credit Card:

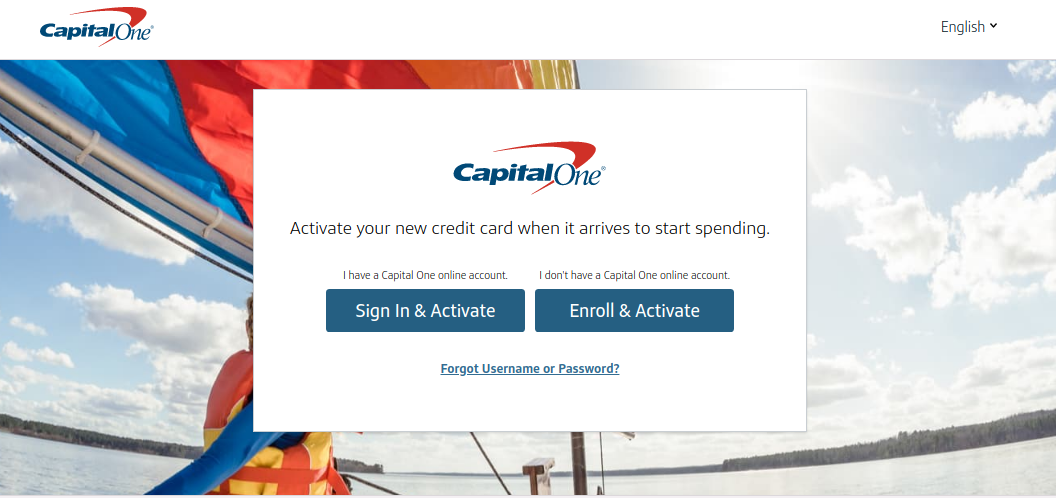

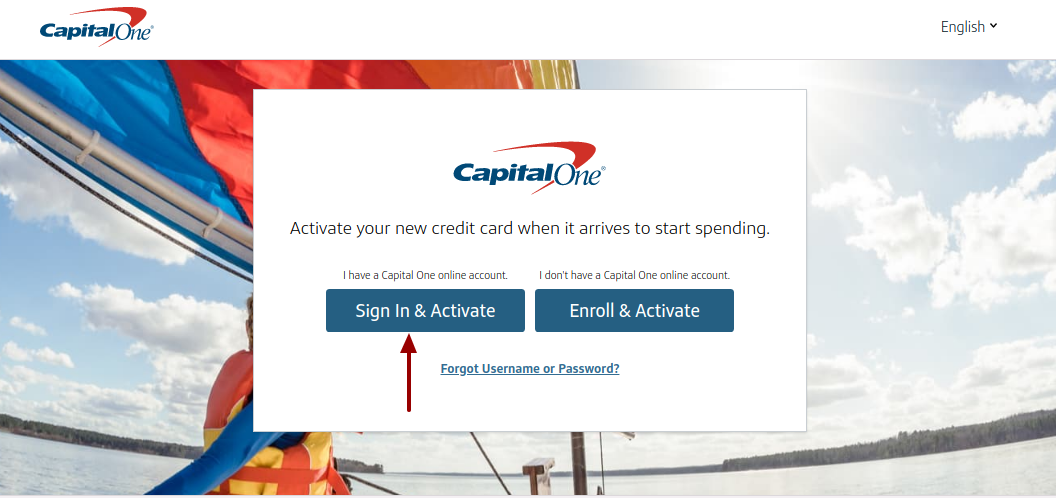

- Firstly, you need to click on this link www.capitalone.com/activate.

- If you have a Capital One online account, then you just have to select the Sign In & Activate option.

- There, you need to input your registered username and password in the given fields.

- After that, you just have to click on the Sign In option to access the portal.

- Once you logged in to your Capital One account, then you can easily activate the Capital One credit card.

- If you don’t have a Capital One online account, then click on the Enroll & Activate option.

- Then, follow the on-screen guideline to activate your Capital One credit card.

Activate Capital One Credit Card by Phone

You are also allowed to activate your Capital One Credit Card over the phone. You just need to follow the on-call instructions to activate the card. You can follow these simple steps below to activate your Capital One Credit Card:

- Firstly, you need to dial 1-800-678-7820 from your registered phone.

- After calling on this number, you will be redirected to the legal card activation advisor. They will give you some simple instructions to activate your Capital One Credit Card. Make sure to follow the on-call instructions to activate your credit card.

- You have to provide your card details, such as the credit card or debit card number, CVV code, expiry date, social security number, etc. You also have to provide some personal details to activate your credit card.

- After you agree with the terms and conditions of your card, your credit card will be automatically activated.

Some of The Credit Cards Offered by Capital One

Capital One offers several credit cards to their customers. These are some of the credit cards offered by Capital One:

Platinum Mastercard

If you don’t want to pay any annual fees on the credit card, then you can apply for the Platinum Mastercard.

- Purchase Rate: The purchase APR for the Capital One card is 26.99%.

- Transfer Info: The intro APR for the fund transfer will be 26.99%. Platinum Mastercard does not charge any transaction fee.

- Annual Fee: You would not be charged any annual fees on this card.

- Credit Level: To apply for the Platinum Mastercard, you will require a fair credit level.

Venture Rewards

Venture Rewards card is a great travel reward credit card. This card allows you to earn unlimited 2X miles per dollar on every purchase. You can get to earn 60000 bonus miles for spending $3,000 on purchases within the first 3 months of account opening.

- Purchase Rate: Purchase APR for the Venture Rewards credit card is 17.24% to 24.49%.

- Transfer Info: The transfer APR of this card is 17.24% to 24.49%.

- Annual Fee: For the Venture Rewards Card, you will be charged a $95 annual fee.

- Credit Level: To apply for this card, you will need an excellent credit level.

Quicksilver Rewards

Quicksilver Rewards is a cashback credit card offered by Capital One. With this card, you will get 1.5% cashback on your everyday purchase. After spending $500 within the first three months, you can earn a one-time $200 cash bonus.

- Purchase Rate: For the first 15 months from the account opening, the intro APR will be 0%. After that, you will be charged 15.49% to 25.49%.

- Transfer Info: For the transfer, your intro APR will be 15.49% to 25.49%. Quicksilver Reward card does not charge any transaction fees.

- Annual Fee: There will be no annual fees on Quicksilver Rewards Credit Card.

- Credit Level: You will require an excellent credit level to apply for a credit card.

How to Apply for Capital One Credit Card

It is quite easy to apply for a Capital One credit card. With your few basic details, you can easily complete the activation process. You have to follow these simple steps below to apply for the Capital One Credit Card:

- Firstly, you need to visit this link www.capitalone.com/credit-cards.

- There, you will see several credit cards offered by Capital One.

- Then, under any specific credit card, you have to click on the Apply Now option.

- There, you have to input your personal details, such as first name, last name, date of birth, and SSN, and select if you are a US citizen or not.

- In the next step, provide your contact details, such as the address, zip code, city, state, email, and primary phone number.

- Then, you have to provide your financial information, such as your employment status, total annual income, monthly rent/mortgage, and bank account.

- Then, you have to agree with the terms of electronic communications disclosure.

- You have to choose your preferred language of communication, between English and Spanish.

- After entering all the necessary details, you just have to select the Continue button.

Also Read

Citizens Bank Clear Value Mastercard Application Process Online

MyCardStatement Login Step by Step Guide