www.nylaarp.com/service – AARP Life Insurance Account Login

Get To Manage Your AARP Life Insurance Program

The AARP Life Insurance Program is an American company that provides the life insurance programs as well as many other related services to the retirees. It started the business way back in the year 1958, some 59 years ago, by the name of the American Association of Retired Persons. The head office of the company has been based in Washington, D.C., U.S.

Life insurance is very important and one of the well-known company like AARP is providing the program for everyone. If you want to be a part of it, you will have to check this article thoroughly.

Create an AARP account

The first thing you have to do is to craete a new account first.

-

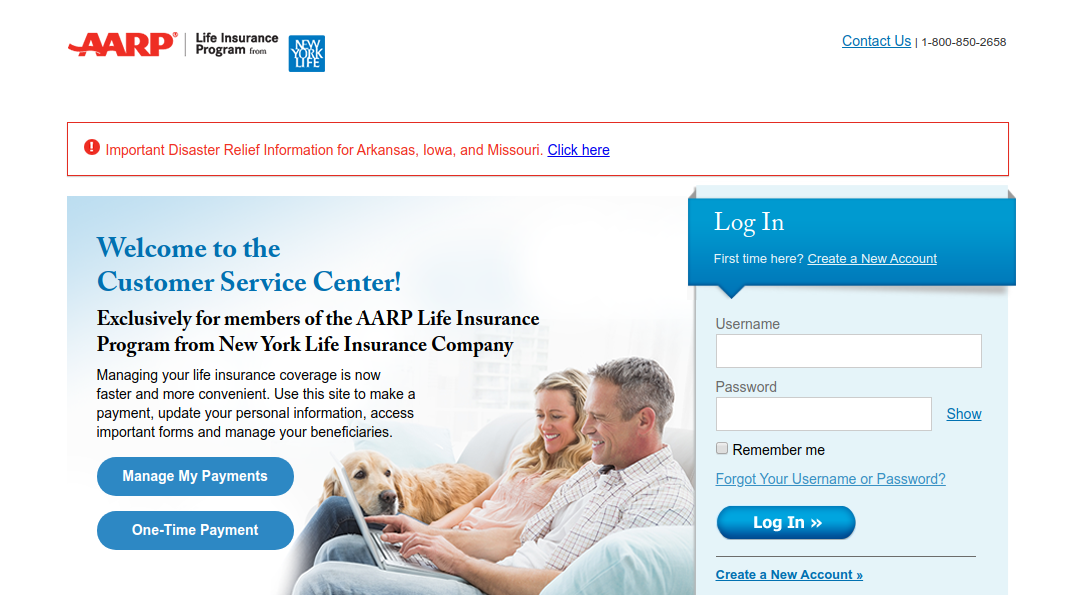

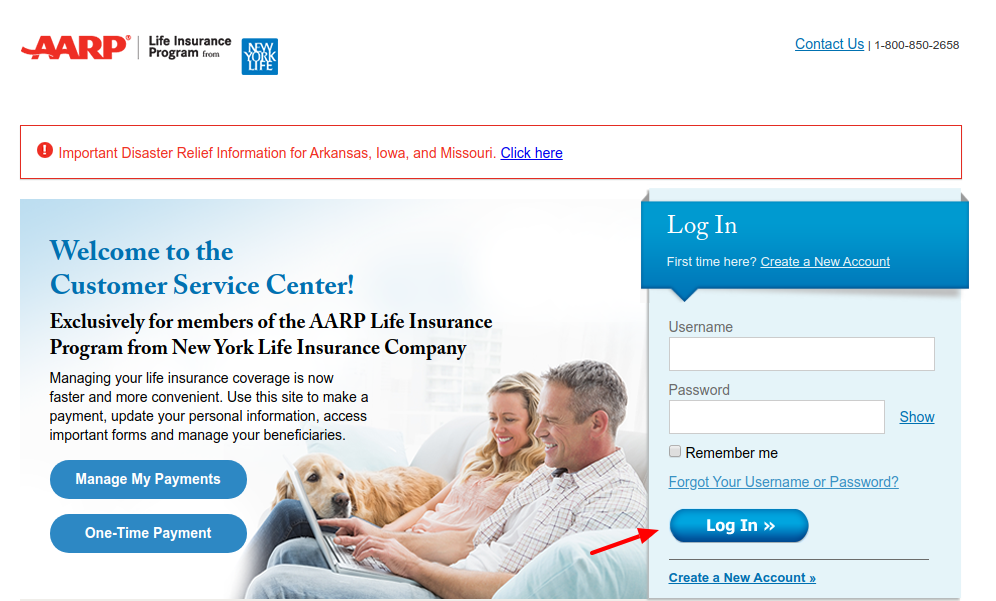

For this part go to, www.nylaarp.com/service

-

Here at the middle right side of the page, you will get the login blanks.

-

Here, inside the box at the bottom, click on, ‘Create a new account’.

-

You have to type

-

Last name

-

Date of birth

-

The last 4 digits of your social security number

-

Certificate number

-

Email address

-

Confirm email address and hit on ‘Continue’.

After this you have to follow the later details after this, you will be able to create an account. Now you have to log in.

Logging into AARP account

To log in go to, www.nylaarp.com/service

Here at the middle right side of the page, you will get the login blanks.

On the exact place type your

Username,

The set password and click on ‘Log in’ and you will be able to log in perfectly.

Forgot login details

If you have lost your AARP login details, then visit the same page and in the login box click on, ‘Forgot your username or password?’. Here enter your

Username or your registered email address

Then, click on the ‘Continue’ button.

You need to follow the prompts afterward and you will be able to retrieve the details.

Advantages of AARP online account

-

Get to manage payment

-

Pay online

-

Manage your account

Pay the AARP insurance

Also Read : PSA Patient Service Account Login

Online payment

For this part, you have to log in to your account by visiting, www.nylaarp.com/service

Here, scroll down and at the right side, you will get the option for logging in. After this aprt, you can pay the bill.

One time payment

For this go to,www.nylaarp.com/service

Here, scroll down and at the right side under the login box, click on, ‘One-time payment’.

-

You will be taken to another page and here input your

-

Contract or Certificate number

-

Owner’s last name

-

Date of birth

-

Owner’s last 4 digits of the social security number

-

Email address

-

Confirm email address and click on ‘Continue’.

Following the later prompts, you can pay the insurance.

Additional info on AARP life insurance program

If you get error message and it persist while trying to access your online account, you need to call New York Life at 1-800-850-2658. A dedicated representative will be there to assist you from Monday – Friday: 8 a.m. to 8 p.m.

Saturday: 9 a.m. to 5 p.m.

You can mail the payments to,

New York Life Insurance Company, AARP Operations

P.O. Box 30711

Tampa, FL 33630-3711

-

To update your Automatic Premium Payment information, go to the My Payments tab once logged in. Click the “Edit” button under the Update Automatic Premium Payment Information section.

-

To view the cash surrender value of a contract, go to the My Coverage tab once logged in. The current cash surrender value, if any, is listed under the life insurance overview within the Coverage Summary section of the contract. If you have multiple contracts, you must select a contract number before viewing the cash surrender value.

-

To report a Life Insurance Claim, download a Claims Packet. Review the instructions and fill out the required forms to begin processing your claim.

-

Mail your Claims Packet and certified death certificate (copies not accepted) to: New York Life Insurance Company, AARP Operations

Attention: Claims Department

P.O. Box 30713

Tampa, FL 33630-3713

-

Term life coverage can last for a set period of time and typically has lower initial rates that increase at set intervals. Typically, it does not build cash value. Permanent life coverage can last your entire life and may have higher initial rates that do not usually increase as you get older. In most cases, it builds cash value over time.

-

Guaranteed Acceptance Life Insurance is permanent life insurance protection that can last a lifetime. There is no medical exam and no health questions required for acceptance. Rates will not increase as you get older. It has limited benefits for the first two years.

-

When listing your beneficiaries, there are three classes that you can choose from for each beneficiary.

-

The different classes tell New York Life how and to whom you want your benefits paid. There must

-

always be a first beneficiary listed before a second or third beneficiary. You need to check the definitions below.

-

First: The person(s) or entity designated as the recipient of the death benefit when the

insured passes away. In order to receive the death benefit, the beneficiary must survive the

insured by 15 days. If there is no surviving First, Second or Third beneficiaries, the

death benefit is payable to the insured’s estate.

-

Second: The death benefit is payable to the second beneficiary if no first beneficiaries

survive the insured by 15 days; or the first beneficiaries are disqualified under the law.

-

Third: The death benefit is payable to the third beneficiaries if no first or second

beneficiaries survive the insured by 15 days; or the first and second beneficiaries are

disqualified under the law.

Contract status definition:

Check below for all contract status definitions.

-

Inforce – Contract is active.

-

Lapse – Contract is no longer active and premiums are past due.

-

Cancelled – Contract is not active because no payments have been received.

-

Cash Surrender – Contract holder voluntarily surrenders contract before maturity date and any

accumulated cash value or pre-paid premiums are paid to contract holder.

-

30-Day Cancel – Contract holder cancels during Free Look Period (first 30 days) and premiums

are refunded.

-

Reduced Paid-Up – The cash value from a permanent life contract is used to purchase a lower

-

face coverage amount – which is paid in full (paid up).

-

Extended Term – When the accumulated cash value in a permanent life contract is used to pay. the term coverage amount for a specified period of time to keep the contract active.

-

Exchanged – A term life contract that has been exchanged for a permanent life contract.

-

Expired – A term life insurance contract that has ended (expired)

-

Matured Contract – A permanent life contract where the ‘termination’ age is reached. For instance, if you are 105 years old, you may be able to request the cash value of your policy.

-

Paid Up – Contract is paid in full. No more premium payments are due.

-

Claim Filed – A first notice of death has been filed. For example, a beneficiary notifies insurance company of contract holder’s death and requests to collect contract coverage amount.

-

A first beneficiary is a person or entity designated as the recipient of the death benefit when the insured passes away. In order to receive the death benefit, the beneficiary must survive the insured by 15 days.

-

If there are no surviving first, second or third beneficiaries, the death benefit is payable to the insured’s estate.

-

A second beneficiary is a person or entity designated as the recipient of a death benefit in the event that no first beneficiaries survive the insured by 15 days; or the first beneficiaries are disqualified under the law.

-

A third beneficiary is a person or entity designated as the recipient of a death benefit in the event that no first beneficiaries or second beneficiaries survive the insured by 15 days; or the first and second beneficiaries are disqualified under the law.

-

A per stirpes beneficiary designation keeps a benefit within family branches. If the primary beneficiary predeceases the insured, the benefit would be paid equally to the surviving natural and/or adopted children of that beneficiary. If there are no surviving descendants in that family, then the benefit is paid to any second beneficiary, or if none, to the estate of the insured.

-

Irrevocable beneficiary means beneficiary of a policy holder’s life insurance contract. If you name someone as an irrevocable life insurance beneficiary, the policy owner cannot change the beneficiary without the beneficiary’s consent. If the person you name as irrevocable beneficiary refuses to consent to the change, the policy owner can do nothing.

-

You may only designate one irrevocable beneficiary per contract in the First Beneficiary Class.

-

A pre-need agreement is a contract between an individual and a funeral home for funeral services after they pass away. ‘Pre-need’ refers to prearranging and funding your own funeral. In order to designate a funeral home as a beneficiary for your life insurance contract, a pre-need agreement will need to be provided.

-

If your beneficiary predeceases you, we request that you update your beneficiary designation. The change may be made online or via a beneficiary designation form.

-

If no changes are made, AARP will honor the benefit to any first beneficiaries who are still living, unless the benefit was designated as per stirpes. If all first beneficiaries have predeceased the insured, the benefit will be paid to the second or third beneficiaries, if you’ve designated any.

-

In the event there are no surviving beneficiaries, the benefit will be paid to your estate. If no estate exists, New York Life has the option to pay the benefit to your next of kin in the following order: spouse or domestic partner, children equally, parents equally or siblings equally. This option requires your next of kin to provide a survivorship affidavit in order to claim benefits. This form will be provided at the time of the claim.

Customer care

To get in touch with AARP life insurance, you can call on, 1-800-850-2658, Monday to Friday: 8 a.m. to 8 p.m. Saturday: 9 a.m. to 5 p.m. Or you can write a mail to,

The AARP Life Insurance Program

P.O. Box 30712

Tampa, FL 33630-3712.

Reference :