How to Apply for Chase Freedom Unlimited Card

JPMorgan Chase & Co. is an investment bank and financial services holding company in America. This public company was founded in the year 2000 and is now based in New York City, New York, United States. this company works with banking and financial services all over the world with 2 lakhs 55 thousand plus workers.

An Overview of Chase Freedom Unlimited Credit Card

Chase Freedom Unlimited Credit Card is a credit card and it comes with various rewards. Usually, this card is known as a cashback credit card and this card can be used with various features and benefits with many other standards or usual credit card benefits.

Rates and Charges of Chase Freedom Unlimited Card

As you know there are some rates and charges for every credit card. And the Chase is also not beyond the rates and charges. So, you have to know about the rates and charges of Chase Freedom Unlimited Credit Cards. And the rates and charges of the Chase Freedom Unlimited Credit Card are as follows.

- For the first year, you don’t have to pay any purchase APR and after one year you have to pay 14.99% to 23.74% based on your credit score and this rate will differ with the market created on the Prime Rate.

- There is a My Chase Loan APR from 14.99% to 23.74%. this rate has the same terms and conditions as the purchase APR.

- Balance Transfer APR is also the same as Purchase APR and has the same terms and conditions.

- There is a 24.99% cash advance APR.

- You have to pay a penalty APR is 29.99% but this APR is payable only when it applies.

- You have to pay your credit card bill within 21 days after closing each billing cycle.

- You don’t have to pay any kind of minimum interest charge.

- No annual membership fee is there.

- You have to pay the bigger amount of either $5 or 5% of the amount of each balance transfer.

- Also, you have to pay the bigger amount of either $10 or 5% of the amount of each cash advance.

- You have to pay 3% of the number of foreign transactions in U.S. dollars.

- Late Payment and Return Payment fees are $40.

Features and Benefits of Chase Freedom Unlimited Card

You can find a lot of features while using a Chase Freedom Unlimited Credit Card with the usual credit card benefits. And the features and benefits are written underneath

- This card comes with a chance to win or earn $200 cashback on spending $500 within three months of account opening.

- There is no prohibition on the number of rewards.

- You can avail yourself of the low APRs while using these credit cards.

- There are cash backs on gas filling, grocery purchases, and other purchases.

- What you will earn as cashback that will never expire.

- To use this credit card you don’t have to pay an annual fee.

Chase Freedom Unlimited Card Application

To use a Chase Freedom Unlimited Credit Card to grow your small business you have to apply for a credit card first. And an application can be done in few minutes online by visiting the Chase Credit card website. You can follow the below steps to complete your Business credit card application.

- First, you have to visit the Chase credit card website by browsing this link creditcards.chase.com

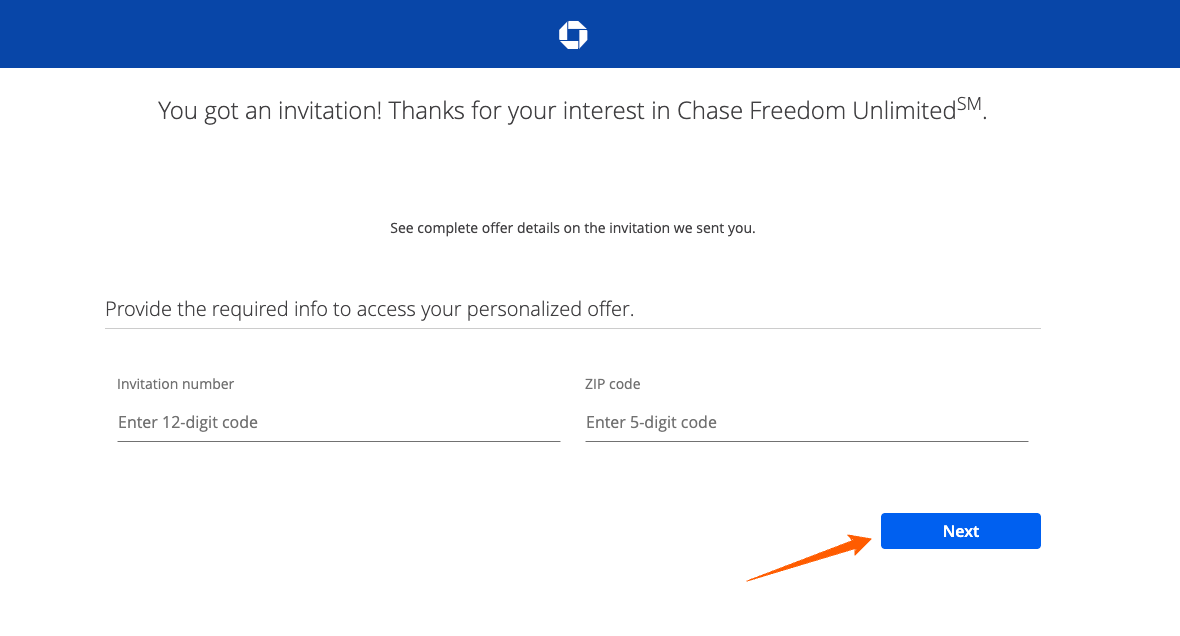

- After that, you have to scroll down that page and then click on the green-colored “Apply Now” button to start the application process or directly go to getfreedomunlimited.com

- Then you have to fill up the application form by entering some details.

- And the details are First name, M.I., Last name, Suffix, mailing address, city, state, ZIP code, Date of birth, Mother’s maiden, Email address, SSN/ITIN, and then you have to enter your annual income then select the time of residence and source of income, phone number, and an alternative phone number.

- After that, you have to scroll down that page and tick the agreement box and click on the “Next” button to complete the procedure.

Chase Freedom Unlimited Card Activation

Once you get your Chase Freedom Unlimited Card in your hand then you have to activate it. And this activation process can be done in two ways inline and by phone. And when you activate your card automatically an account on the Chase credit card website will be created to access and manage your credit card online. The activation procedure is written underneath in very simple steps.

By Online

- You have to visit the Chase website first by clicking on this link www.chase.com

- Then you have to make click on the “Sign in” button.

- After that, you will be redirected to the Sign in portal and then you have to click on the “Not Enrolled? Sign Up Now. >” to start the activation process.

- Now you have to enter your account or card number and the Social Security Number and have to create a Username (as per the direction under the given space).

- After entering such details, you have to click on the “Next” button and follow the rest procedures to complete the activation process.

By Phone

This card activation process also can be done through a phone call. To complete this procedure by phone call you have to make a call on this number 800-432-3117 and follow the instructions and share the details to complete the activation procedure.

Chase Freedom Unlimited Card Account Creation

If you want to manage your Chase Freedom Unlimited Card through an account. Then you have to open an account first and the account opening process can be done online. And the account-creating process is written here below with very simple steps.

- First, you have to browse this link creditcards.chase.com to start the process.

- After that, you have to click on the “Sign in” button from the top right corner of that page.

- And then you will be redirected to the Sign-in portal and then click on the “Not enrolled? Sign up now. >” button to start the account creation process.

- Then you have to select the account type as per your requirement.

- After that enter your account or card or application number, Social Security Number, and then create a username as per the direction.

- Then click on the “Next” button and follow the next instructions to complete the process.

Chase Freedom Unlimited Card Account Login

Once you activate your card online then you have to login into your account to access your card or manage your credit card or for any other activity with your Chase Ink Credit Card. And the login procedure is illustrated here underneath with very simple steps.

- First, open your browser and browse this link www.chase.com and then reach the Sign in the portal by clicking on the “Sign in” button available on the top right corner of that page.

- And then you will reach the sign-in portal and have to enter your Username and Password in the given place.

- After that, you have to click on the “Sign in” button to sign in to your online or credit card account.

Chase Freedom Unlimited Card Account Log-in Details Recovery

If you can’t remember your login credential or anyone among the Username or Password then you have to recover it to access your account online and manage your account. If you don’t recover your login credentials then you can’t access your account. And the recovery procedure is discussed underneath.

- First, you have to click on this link www.chase.com, and reach the Chase website.

- And then you have to click on the “Sign in” button to reach the sign-in portal.

- From the sign-in portal, you have to click on the “Forgot username/password” button to start the recovery process.

- Then you will be redirected to a new page and you have to enter your Social Security Number or Tax ID (TIN) and Account, Card, or application number.

- After entering the details, you have to click on the “Next” button and follow the further procedure to complete the recovery process.

Also Read

Commerce DirectCheck Card Activation Process

Activate your Wisely Card Online

How to Apply Boost Platinum Credit Card Online

Chase Freedom Unlimited Card Bill Payment

If you are using a Chase Freedom Unlimited Card then you have to pay your credit bill at the due date. And there are several methods available to pay your credit card bill. And the methods are Online, By Mobile App, By Phone Call, From a Chase ATM or Branch, and By Mail. And the detailed payment procedures are illustrated underneath.

In Online

- To make an online credit card bill payment you have to visit the website first by browsing this link www.chase.com

- And then you have to complete the sign-in procedure as mentioned above.

- And then follow the instructions to complete the payment procedure

From Mobile App

The online method and from mobile app method are quite the same. To make your payment through a mobile app you have to download a Chase Mobile App. And then complete the sign-in process and follow the further instructions and provide your card details to complete the bill payment procedure.

By Phone

You can complete your Credit Card bill payment through a call. And if you choose this option that means if you want to pay your credit card bill by a phone call then you have to dial this number 1-800-436-7958 from your phone and follow the directions to complete your bill payment.

Through an ATM or Branch

You can visit the nearest Chase ATM or Brach to pay your credit card bill.

By Mail

There is also an option to pay your Chase Freedom Unlimited Credit Card bill. And the way is to send a mail. You just have to send your check or money order of your bill amount and account number to the below mailing address. But don’t send your billing amount in cash.

Cardmember Services

P.O. Box 6294

Carol Stream, IL 60197-6294

Contact Information

Customer Service of Chase

1-800-935-9935