www.nationaldebtrelief.com/apply – Apply for National Debt Relief Offer Online

How to Apply for National Debt Relief Offer :

National Debt Relief company offers relief through a process known as debt settlement, which mainly helps the consumers to get out of debt. With the debt settlement, you will get an amount of money in a savings account every month until you can settle your debts for less than you owe.

You will pay National Debt Relief a percentage of the debt they settle, only after you get the result. This company claims that even after the accounting of their fees, customers can save around 30% to 50% of their debit b the time the process is complete.

How to Apply for National Debt Relief :

In order to apply for the National Debt Relief, you have to follow these simple steps below:

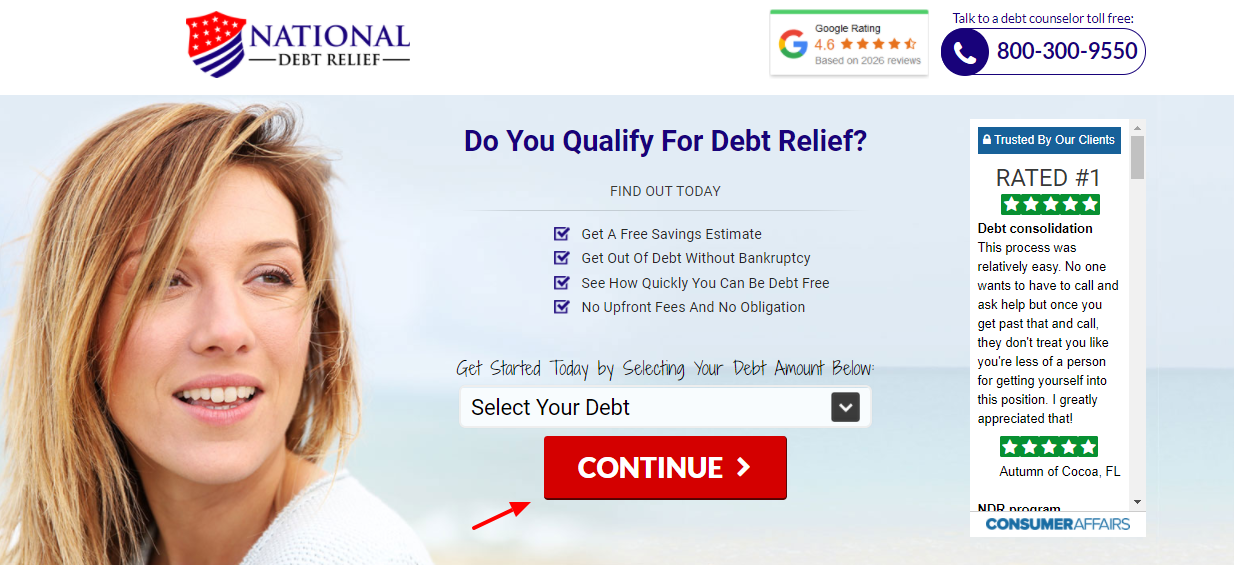

- You have to click on this link www.nationaldebtrelief.com/apply.

- Then, you have to select your debt from the drop-down menu and click on the Continue button.

- You have to provide your first name, last name, phone number, and email address.

- After entering all the required details, simply click on the Click Here option.

- Then, you can simply follow the on-screen guideline to check if you are qualified for debt relief or not.

Pros and Cons of National Debt Relief :

Pros:

- Here you only pay when you get the results. Fees are charged as a percentage of debt that is settled, and only after the settlement is complete.

- You can contact the National Debt Relief to speak with a counselor for free. Here you will get the chance to ask questions and find out if debt settlement is right for you.

- Unlike the other debt relief firms, National Debt Relief offers an online client portal that lets you oversee your program and track your debt settlement process at any time of the day or night.

- National Debt Relief is accredited with the A+ rating.

Cons:

- Some companies charge fees at a lower percentage than National Debt Relief.

- Although, they have an online client portal, don’t have a mobile app that lets you track your debt settlement program on the go.

Types of Debt Addressed :

The main target of the National Debt Relief is to help the consumers to pay off their unsecured debt, which could be any type of debt that is not secured by collateral. You will get a debt qualifications page on their website, where they explain which debts do and do not qualify. These are some main types of debts highlighted below:

Credit Card Debt:

If you have a traditional credit card debt, National Debt Relief can help you to settle it for less than you owe. This applies to some major credit cards like Visa, American Express, Discover as well as co-branded cards from retailers like Kohls or Sears.

Personal Loans and Payday Loans:

You can also settle any personal debt you have, including personal loans or payday loans. Installment loans are also qualified for this program.

Business Debts:

Business debts can also be negotiated for less than you own now. Make sure that these loans are unsecured, and they prefer to help negotiate debts for businesses that are already closed.

Private Student Loans:

You can settle your student loans for less than your total balance. You should know that federal student loans are not qualified for debt settlement.

Also Read : MyMedicare Secure Login

National Debt Relief Contact Info :

If you have any queries about the National Debt Relief, then you can contact the customer service department. You have to visit the customer service page at www.nationaldebtrelief.com/contactus.

Reference Link :

www.nationaldebtrelief.com/apply